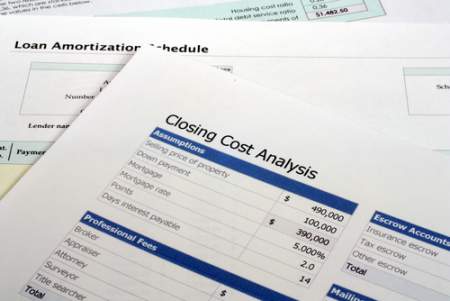

Buying a home can be complicated if you are not sure what type of costs are needed to be paid. The closing costs are one of the things that home buyers should be familiar with to calculate the added expense. For many home buyers, the type of added costs may be confusing and hard to understand if this is the first time purchasing a home. Here are a few details to help make the transition of home purchasing a little less stressful.

💲 What are closing costs?

The closing costs that home buyers pay can involve a number of fees, services, and expenses. These costs can entail loan fees from a financial institution. If your borrowing money from a bank or financial organization, they may have a set of fees that are included in the home buying purchase. When buying a home, it is important that the home is appraised to determine the average sale price in the neighborhood. Appraisal fees can be added into the closing costs at the final closing date. Deed searching services and taxes can also be included in the final closing costs that home buyers are recommended to pay. If a credit report is needed for the purchase of the home, these fees can also be included in the closing costs. It is important to find out what type of costs are needed to be paid before the final sale date for your convenience. The term closing costs can include several factors when purchasing a home.

The closing costs that home buyers pay can involve a number of fees, services, and expenses. These costs can entail loan fees from a financial institution. If your borrowing money from a bank or financial organization, they may have a set of fees that are included in the home buying purchase. When buying a home, it is important that the home is appraised to determine the average sale price in the neighborhood. Appraisal fees can be added into the closing costs at the final closing date. Deed searching services and taxes can also be included in the final closing costs that home buyers are recommended to pay. If a credit report is needed for the purchase of the home, these fees can also be included in the closing costs. It is important to find out what type of costs are needed to be paid before the final sale date for your convenience. The term closing costs can include several factors when purchasing a home.

💵 What are closing costs based on?

Not all home buyers will have the same amount of closing costs to pay at the final closing date. There are several factors that can be determined to understand how much and for what you are paying these costs. Many home buyers are expected to pay a percentage of 2-5 percent of the purchase price of the home they are buying. This cost alone can vary based on the actual sale price that the home.

Some financial institutions or real estate sales will charge an application fee that is included at the final closing of the home. An attorney fee can also be included. This is only if you choose to have an attorney look over the final documents before signing the final paperwork for the closing sale. Not everyone will have this expense if they do not utilize a legal professional for document review. Insurance is another fee that can be included in the closing expenses. It is recommended to have insurance on the home for adequate coverage at the time of closing. This protects the buyer and seller in case of something happening to the home. The fees that are charged for transferring the home from seller to buyer may also be included in these added expenses at the end of the sale. Some of these fees can be expected if you’re thinking about buying a new home.

💰 What are typical closing costs for buyers?

There are some typical closing costs that buyers can expect even if you don’t use the other types of expenses for your purchases. The fees for deed transfer, home inspection, appraisal, the percentage of the purchase price, and property insurance are typical costs to expect at the time of closing. If you choose to use a legal representative to understand the paperwork, then these fees will also be considered in the final expenses at the time of sale. If you’re not sure what costs you will be asked to pay, then it is important to ask the real estate agent or financial instruction for a specific list of expenses. This will help you prepare for the final sale day and make the transition of home buying easier.

There are some typical closing costs that buyers can expect even if you don’t use the other types of expenses for your purchases. The fees for deed transfer, home inspection, appraisal, the percentage of the purchase price, and property insurance are typical costs to expect at the time of closing. If you choose to use a legal representative to understand the paperwork, then these fees will also be considered in the final expenses at the time of sale. If you’re not sure what costs you will be asked to pay, then it is important to ask the real estate agent or financial instruction for a specific list of expenses. This will help you prepare for the final sale day and make the transition of home buying easier.

📝 Which closing costs are tax deductible?

There are some closing expenses that can be tax deductible. The deduction needs to be included on the taxes of the year you bought the home. It is recommended to itemize the deduction and not do a standard deduction on taxes. The home mortgage interests that was included in closing costs may be deducted. This amount can be found on the mortgage interest document that was provided by the seller or lender. Sales taxes and some real estate taxes can be deducted on your taxes as well. Some mortgage insurance can also be included in tax deductions if it is not from the Rural Housing or Veteran Affairs organizations. If you’re not sure of other items that you may want to deduct it important to ask a real estate agent or the IRS for adequate deduction.